Recession fears are back in the headlines. If you’re thinking about making a move—buying or selling a home—you might be wondering whether now is the right time, or if it’s better to wait things out.

You’re not alone. A new survey by John Burns Research and Consulting and Keeping Current Matters reveals that 68% of Americans are holding off on their housing plans due to economic uncertainty.

But here’s where it gets interesting.

Not Everyone Is Holding Back Out of Fear

Nearly 30% of buyers say a recession would make them more likely to purchase a home, according to Realtor.com. Why? Because there’s a common belief that a recession might lead to lower mortgage rates and potentially lower home prices.

There’s some truth to that.

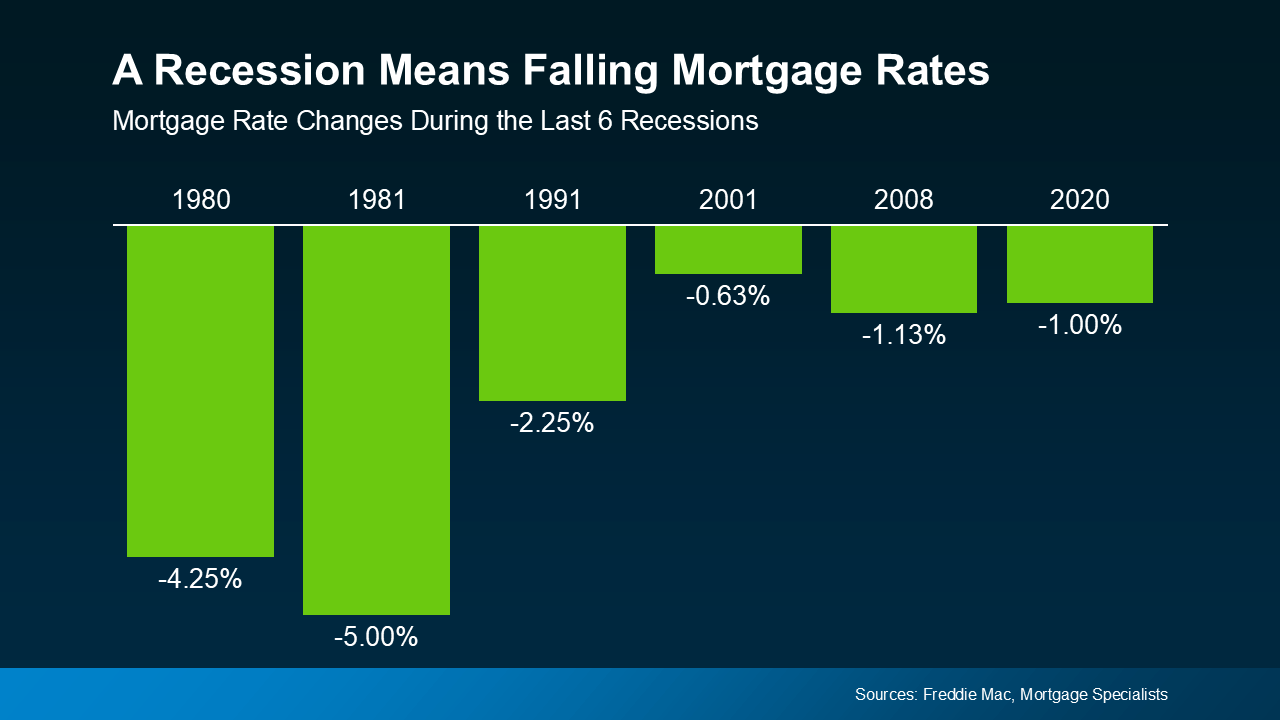

As this chart illustrates, mortgage rates tend to fall when the economy slows down, as the Federal Reserve typically lowers interest rates to stimulate economic activity. That can make homeownership more affordable.

As this chart illustrates, mortgage rates tend to fall when the economy slows down, as the Federal Reserve typically lowers interest rates to stimulate economic activity. That can make homeownership more affordable.

But assuming that home prices will also drop? That’s where most people get it wrong.

History Shows Home Prices Usually Rise During Recessions

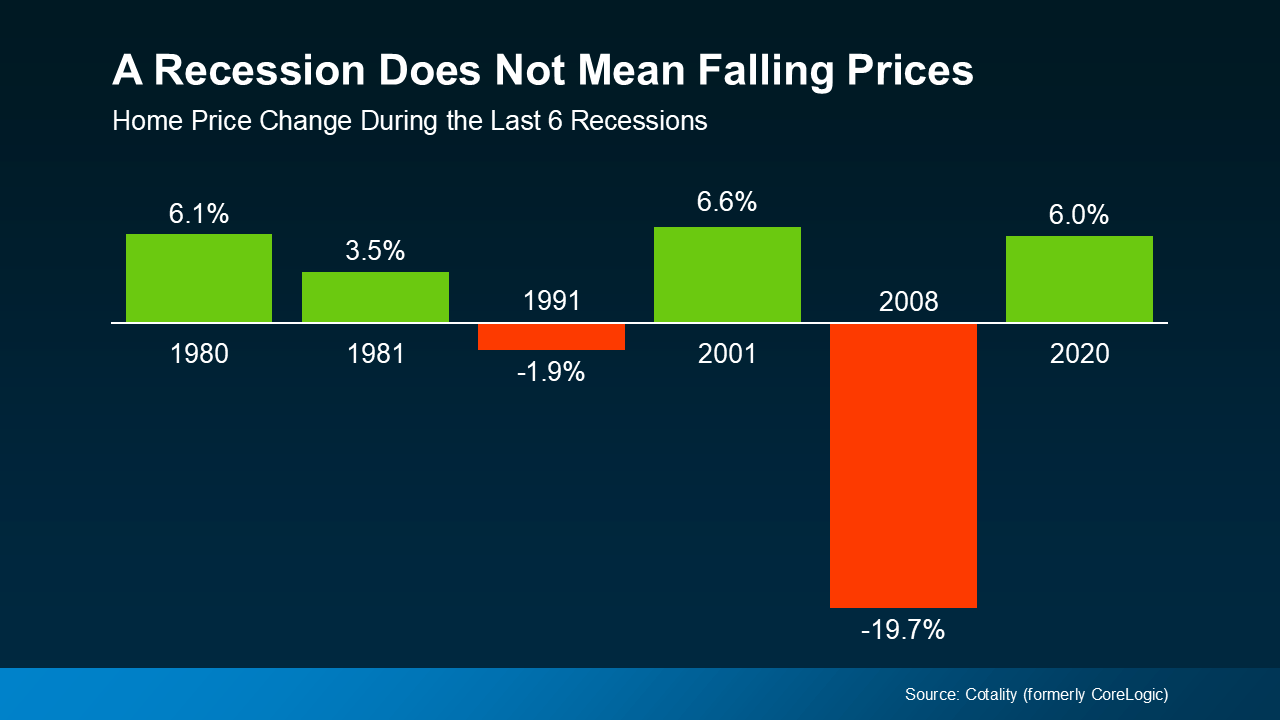

While mortgage rates tend to dip, home prices do not consistently fall during recessions. Prices rose in four of the last six downturns.

The 2008 housing crisis is the outlier, not the norm. Today’s market is very different. We’re still dealing with a long-standing inventory shortage, and demand remains steady in many regions. That keeps upward pressure on prices, even if the rate of appreciation has slowed.

The 2008 housing crisis is the outlier, not the norm. Today’s market is very different. We’re still dealing with a long-standing inventory shortage, and demand remains steady in many regions. That keeps upward pressure on prices, even if the rate of appreciation has slowed.

As Robert Frick, Corporate Economist at Navy Federal Credit Union, puts it:

“Hopes that an economic slowdown will depress housing prices are wishful thinking at this point.”

The Real Risk of Waiting

If you delay your move, hoping for a double dip in rates and prices, you could miss the market entirely. That dream scenario might never materialize, and in the meantime, you may lose buying power or equity growth opportunities.

Bottom Line

It’s smart to keep an eye on economic trends, but don’t wait for the “perfect” recession to make your move. Mortgage rates could dip, yes—but a significant price drop? Not likely.

If you’re serious about buying or selling, let’s sit down and make a game plan that works with today’s market, not the one in the headlines.