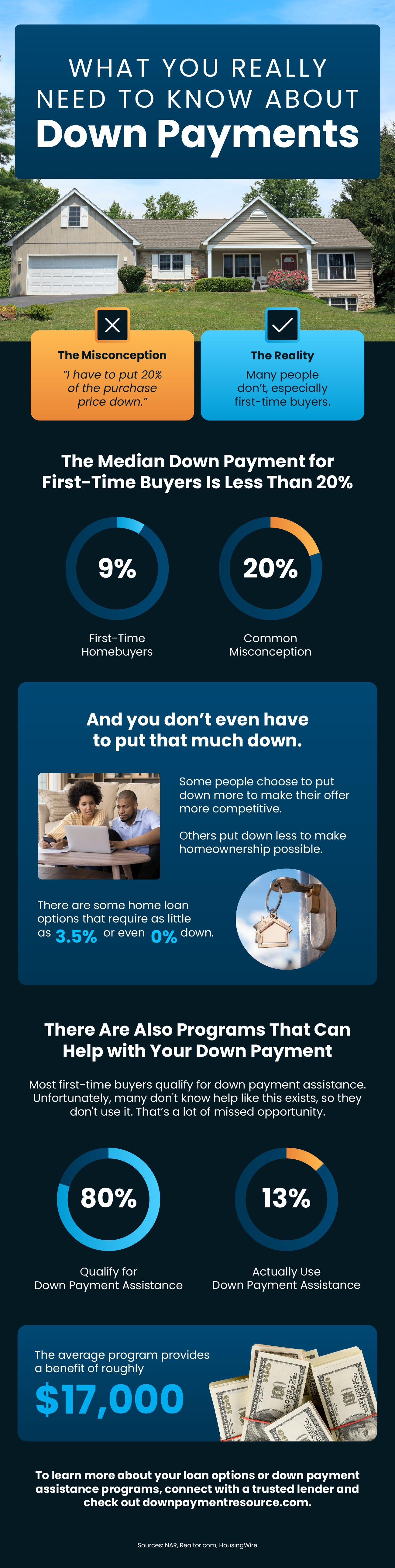

If you're thinking about buying a home in Rhode Island or Massachusetts, you've probably heard that you need a 20% down payment to get started. But the truth is, that number is more myth than requirement.

In reality, many successful buyers — especially first-timers — put down far less.

The 20% Down Payment Myth

A 20% down payment may offer benefits, such as avoiding private mortgage insurance (PMI) or making your offer more competitive, but it’s not a requirement to buy a home.

According to recent studies, most buyers put down significantly less, with many qualifying for mortgages with as little as 3% to 5% down.

There’s Help Available — and You Might Qualify

Many first-time buyers are surprised to discover the extensive support available.

Through local and national down payment assistance (DPA) programs, you may be eligible for grants, forgivable loans, or low-interest second mortgages that cover part of your upfront costs.

💡 What is the average benefit from a DPA program? Around $17,000.

To explore your options, visit DownPaymentResource.com and be sure to speak with a trusted local lender who understands our regional programs in Massachusetts and Rhode Island.

Start with the Right Strategy

Whether you’re buying your first home or moving up, you don’t have to figure this out alone. A great agent and lender can walk you through your options, make sure you’re asking the right questions, and help you access the best tools available.

If you're wondering how much house you can afford or what it might take to get started, we’re here to help.

📘 Start with a free personalized home affordability estimate:

→ Request Your Custom Home Valuation

Related Reading: